Corporation Tax Loans

We Pay HMRC Up Front

You pay us back monthly

Pay up to 14 Days After your Bill is Due

We can still arrange funding if you're running up to 2 weeks late in payment

Choose Your Own Funding Terms

Pay over 3, 6, 9 or 12 month

48 Hours till Corporation Tax Pay Out

From your enquiry, we can have the funds to HMRC within 48 Hours

Fast Payment on Corporation Tax

Our Corporation Tax loans are designed with flexibility in mind with options to spread payments over 3 to 12 months.

· Fast decisions

· Fixed monthly repayments

· No personal assets required as security

· Spread payments over 3 to 12 months

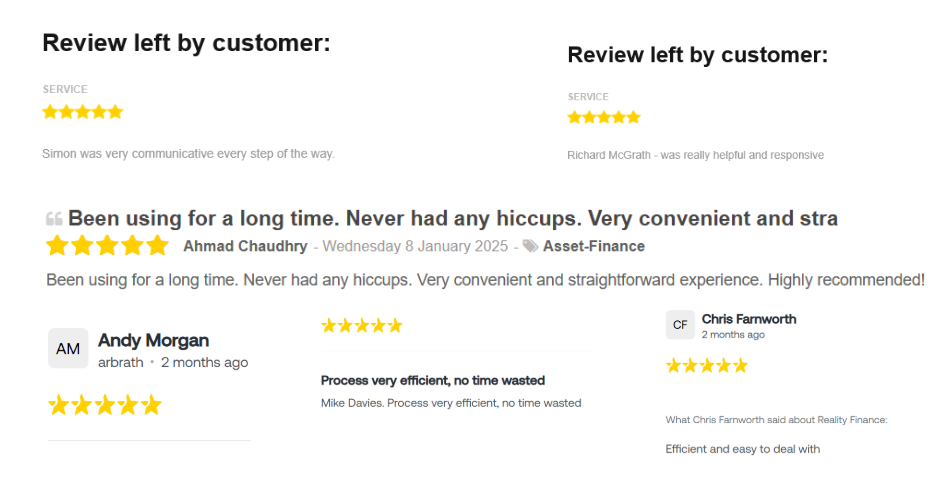

What Do Our Customers Say?

How to Arrange a Corporation Tax Loan

- 1. Email info@realityfinance.com, call us on 01483 413859 or submit a call back request below. Initially we will need your Limited Company Name, and how much your Corporation Tax bill is.

- 2. We will provide you with a quote to fund your Corporation Tax.

- 3. If agreeable, we will continue with the application and credit checks.

- 4. Once approved, funds can be with the HMRC or yourself within 24 hours.

Information Required for your Corporation Tax Funding

- 3 months of business bank statements

- The most recent set of management accounts, if available

- A summary of your last 12 months' revenue, broken down by month

- Full set of Accounts if established over 12 months and lodged to companies house

- A copy of your Tax Bill from HMRC

Depending on the amount of your Corporation Tax Bill, and the turnover of your business, you may be asked to supply your latest set of accounts.

Again, depending on your circumstances some Lenders may want to see at least 3 months of bank statements (so they can check you have a healthy cash flow) and also require that at least one Director resides in the UK.

Corporation Tax FAQ’s

Q: What is the maximum Corporation Tax Bill you will fund?

A: We will fund your HMRC Tax or VAT bill up to £15 million.

Q: Do you require a personal guarantee?

A: If your Corporation Tax Bill bill is under £150,000 then we do not require a personal guarantee.

Q: Are there any upfront fees?

A: No we do not charge any upfront fees or documentation fees for Corporation Tax Loans. We do however add a very clear transaction fee, which is added to your monthly payment amounts.

Q: Will the application affect your Credit Score?

A: If you’re a limited company or LLP, you can get a decision on your credit limit without affecting your credit score.

Q: Will I receive Account Manager Support?

A: Yes! Unlike many high street Lenders or big advertisers out there, you will have a single point of contact at Reality Finance who understands your business. Eventually you will think of us as an external member of your team.

Why Use a Corporation Tax Loan?

Take Control of Your Payments

Corporation Tax is an essential part of running a business, but making large lump-sum payments can put a strain on your cash flow. At Reality Finance, we offer tailored Corporation Tax funding solutions to help you spread the cost of your tax liabilities, allowing you to manage your finances more effectively without disrupting your day-to-day operations.

Flexible Funding to Fit Your Business Needs

Our Corporation Tax loans are designed with flexibility in mind, offering repayment terms that suit your business’s unique financial situation. With options to spread payments over 3 to 12 months, you can maintain control of your working capital, ensuring you have the funds available to invest in growth opportunities or cover unexpected costs. We provide fast decisions, fixed monthly repayments, and no personal assets required as security.

Streamline Your Tax Payments

Avoid the stress of last-minute Corporation Tax payments and the potential penalties for missed deadlines. Our simple and transparent tax funding process ensures that you can meet your HMRC obligations without sacrificing cash flow. With Reality Finance, you’ll receive industry-leading rates, a high acceptance rate, and the support of a dedicated account manager to guide you every step of the way.

Why Reality Finance?

5 star service rating

Verified by Feefo

Over 30 lenders on our panel

so we can source you the best deal

Lender in our own right

Provides additional flexibility

Funding hard and soft assets

Anything you need for your business

24 years of trading

Established in 2000 and privately owned