How Asset Finance works

Asset Finance is a commercial arrangement where the customer will select an asset, the finance company will purchase that asset and the customer will have use of that asset during the lease. The customer simply pays a series of installments for the use of the asset for the duration of the agreement. What happens at the end depends on the type of the agreement, we will cover that in more detail a bit further on.

What is an Asset Finance Broker?

An Asset Finance Broker works closely with the customer to understand their business and requirements. They provide advice and guidance on the most appropriate method of funding and find the best rates available for the business. They are essentially a bridge between the customer and multiple funders, meaning the customer can sit back and relax in the knowledge that their Broker is getting them the best deal. Reality Finance is a broker with a difference; we are also a Lender in our own right. This means we can often provide funding for our customers in situations when other banks and lenders are unable to.

How to get financing for a business

The first thing you need to establish before approaching a broker or lender is the equipment or asset your business requires and its rough value. This could be in the form of a quote from a supplier. Once you have this information you will generally find that the most beneficial route is to speak to a Broker.

Traditionally, businesses have approached their principal bank and then only approached a Broker if their application is rejected or if the rate offered is high. By speaking to a Broker in the first instance you can compare quotes from multiple funders, and know that your Broker is working hard to get you the most appropriate deal and type of funding for your business.

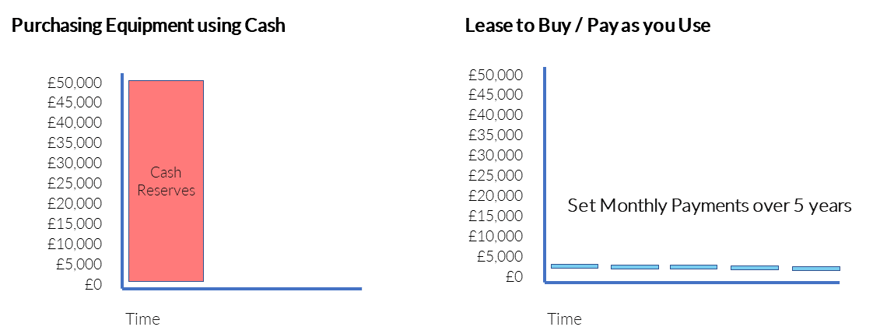

Why Lease?

Leasing helps businesses keep ahead of the game by giving them access to emerging technology and equipment to maintain their competitive edge. Businesses can quickly gain up-to-date equipment whilst spreading the cost, meaning they can retain their capital to invest in other areas of the business. Leasing also helps businesses to manage their cash flow, forecast and plan ahead. Equally, Leasing can provide a safety net if business critical equipment needs replacing quickly. For example, if a caterer’s oven was to break, they would be able to replace it quickly and continue business as usual.

Can second-hand equipment be financed?

Yes, businesses can acquire second-hand assets such as refurbished equipment using a finance agreement. Different lenders have different terms for these agreements, meaning that working with an experienced broker will save you time as they will only speak with appropriate lenders.

Hard vs Soft Assets