Confidential Invoice Discounting

- Unlock cash tied up in outstanding invoices

- 100% confidential facilities available

- Smarter than an overdraft

- Quick and easy to transfer existing facilities

- Connects Directly to your Accounting package

Reliable and Confidential Invoice Discounting

Our Invoice Discounting Facility ensures that you can release cash tied up in unpaid invoices quickly and confidentially. We’re trusted by companies across the UK to provide flexible cashflow solutions that fit their needs. As specialists in invoice discounting we regularly help businesses unlock working capital while keeping their customer relationships firmly under control. Discover how quick and easy it is to set up Invoice Discounting for your business by speaking to one of our specialists.

Why choose Invoice Discounting?

If your business relies on an overdraft to manage cashflow, confidential Invoice Discounting could be a smarter alternative. Instead of borrowing against future earnings, you unlock cash that’s already yours — tied up in unpaid invoices. We can advance up to 90% of invoice value, often within 24 hours, giving you the working capital you need to grow without waiting weeks or months for customers to pay.

Invoice Discounting bridges the cashflow gap between raising an invoice and receiving payment — typically 30 to 120+ days — so you can cover expenses, seize opportunities, and keep your business moving.

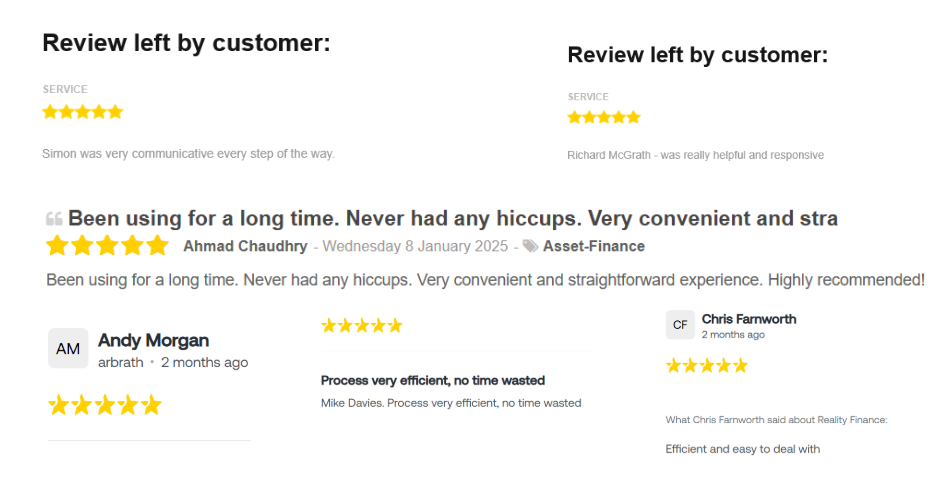

What Do Our Customers Say?

Get immediate access to cash without a Business Loan

Invoice discounting works for any business that wants to release money from their invoices more quickly, improve cash flow, or spend less time chasing late payments.

-

Smarter than an overdraft – release money from your sales, not from your future

-

No personal guarantees (on some facilities)

-

Confidential invoice discounting facility – your customers won’t know

-

Rolling monthly agreement – no long-term lock-in

-

Only pay for what you use – no set-up or idle charges

-

We connect directly into your accounting package – seamless and automated

-

You stay in control – continue to manage your customer relationships

FAQ's for Invoice Discounting

Q: Is invoice discounting a loan?

A: No – it’s a facility secured against your outstanding invoices. You’re not borrowing in the traditional sense.

Q: Will my customers know?

A: No – most invoice discounting facilities are completely confidential.

Q: Can I choose which invoices to fund?

A: Some providers offer selective invoice discounting – others will fund the full sales ledger.

Q: Can I add bad debt protection?

A: Yes – non-recourse options are available, which protect you if a customer doesn’t pay.

Q: Do I need to change how I do credit control?

A: Not necessarily – you can keep your existing processes in place. However, strong credit control is encouraged.

Q: Is there any contractual commitment term, or lock-in, and are there penalties for early termination?

Standard term is 12 months with 3 months’ notice. Early exit may incur fees.

Q: What is the fee model and structure for Invoice Discounting?

Service Fee – a percentage of invoices or fixed monthly charge. Discount Fee – borrowing cost, typically 2.5% above the Bank of England base rate, only charged when you draw funds.

More information about Invoice Discounting

When considering an Invoice Discounting facility, most businesses want to know about the commitment and costs involved. Typically, agreements run for 12 months before moving onto a rolling contract, with clear guidance on notice periods and any early exit fees.

The fee model is straightforward, with a service fee for keeping the facility in place and a discount fee, usually around 2.5% above base rate, for the funds you actually draw down. Companies can usually access up to 90% of invoice values, and importantly, you retain full control of your credit control and dunning process — meaning you decide how and when to chase payments. Unlike invoice factoring, there’s no offshoring and no third party contacting your customers, so you maintain direct client relationships.

Security is standard across the industry, so facilities are usually backed by an All Assets Debenture, which can sit alongside your bank’s overdraft charge via a Deed of Priority. Directors may be asked for personal guarantees depending on the strength of receivables and balance sheet.

Bad debt risk generally remains with the client, though protection can be added through specialist insurance. To help manage everything, our Intelligent Cashflow platform integrates with leading ERP and accounting systems, giving you real-time reporting on payments, reserves, and funding availability.

Onboarding is straightforward, requiring documents such as accounts, debtor and creditor reports, forecasts and sample invoices, with ongoing management kept simple through monthly updates.

Cashflow is improved almost instantly, with funds made available the same day invoices are raised — and if you request before 1pm, money can be in your account by 3pm. Reserves are applied transparently and clearly shown on your dashboard, helping you decide when to suspend services or adjust customer terms.

Because Invoice Discounting leaves control with you, it’s important to maintain your own AR resource, though TUPE does not apply as collections stay in-house. In short, Invoice Discounting gives you quick access to working capital, up to 90% of your invoices, while keeping customer management firmly in your hands.

How our Invoice Discounting Works

Instead of Invoicing your customer, and waiting for them to pay according to the invoice terms, you sell your invoice onto us, which you will then be paid 90% of the value up front.

1

Notify your customers of change in bank details

2

We invoice your customer on your behalf

3

A percentage of the invoice value gets paid straight to you (between 70-95%)

Why Reality Finance?

5 star service rating

Verified by Feefo

Over 30 lenders on our panel

so we can source you the best deal

Lender in our own right

Provides additional flexibility

Funding hard and soft assets

Anything you need for your business

24 years of trading

Established in 2000 and privately owned