VAT Loans

Spread Your Quarterly VAT Bill

We Pay HMRC Directly

So you can continue to pay us back on a monthly basis

48 Hour Turn Around

Between receiving your VAT finance enquiry and paying out funds

Funding for Late Submissions

We can refund your VAT bill up to 14 days after its been paid

Fast VAT Loans

VAT payments are a legal requirement, but they don’t have to create headaches for your business.

With a VAT loan from Reality Finance, you can manage your tax obligations without disrupting your cash flow.

We can have your VAT paid, directly to HMRC within 48 hours of your enquiry.

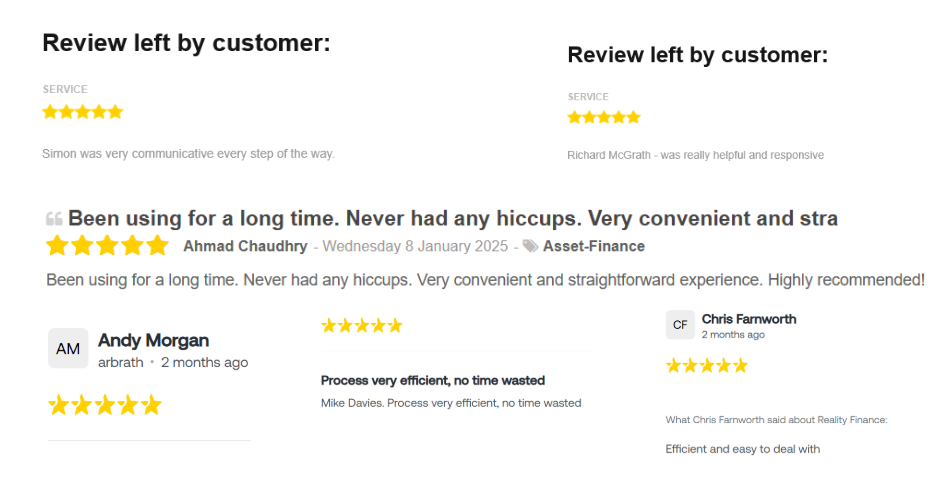

What Do Our Customers Say?

How does a VAT Loan Work?

Once approved, we pay the VAT directly to HMRC, and you repay the loan in monthly instalments, usually over a period of 3 months. Our straightforward process ensures that you can focus on your business while we handle the financial details. With VAT loans ranging from £10,000 to £15 million, we tailor our solutions to meet your business’s unique needs.

Why Might You Need a VAT Loan?

- Seasonal cash flow fluctuations

- Unexpected costs, like repairs or equipment

- Planning for future investments

- Managing tight cash reserves

Late VAT payments can lead to penalties, interest charges, or even investigations. By securing a VAT Loan, you can avoid these issues and maintain control of your finances.

Our application process is simple and fast. You’ll need to provide documentation, including proof of identity, business address, and financial statements. In many cases, you can receive approval within 48 hours, with funds paid directly to HMRC shortly after.

Take the stress out of VAT payments. Talk to us today to find out how a VAT loan can help keep your business running smoothly.

How to Arrange a VAT Loan

- 1. Email info@realityfinance.com, call us on 01483 413859 or submit a call back request below. Initially we will need your Limited Company Name, and how much your VAT bill is.

- 2. We will provide you with a quote for a VAT Loan.

- 3. If agreeable, we will continue with the application and credit checks.

- 4. Once approved, funds can be with the HMRC or yourself within 24 hours.

VAT Loan FAQ's

Q: What is the maximum you will fund?

A: We will fund your HMRC Tax or VAT bill up to £15 million.

Q: Do you require a personal guarantee?

A: If you bill is under £150,000 then we do not require a personal guarantee.

Q: Are there any upfront fees?

A: No we do not charge any upfront fees or documentation fees for VAT Loans. We do however add a very clear transaction fee, which is added to your monthly payment amounts.

Q: Will the application affect your Credit Score?

A: If you’re a limited company or LLP, you can get a decision on your credit limit without affecting your credit score.

Q: Will I receive Account Manager Support?

A: Yes! Unlike many high street Lenders or big advertisers out there, you will have a single point of contact at Reality Finance who understands your business. Eventually you will think of us as an external member of your team.

Why Reality Finance?

5 star service rating

Verified by Feefo

Over 30 lenders on our panel

so we can source you the best deal

Lender in our own right

Provides additional flexibility

Funding hard and soft assets

Anything you need for your business

24 years of trading

Established in 2000 and privately owned