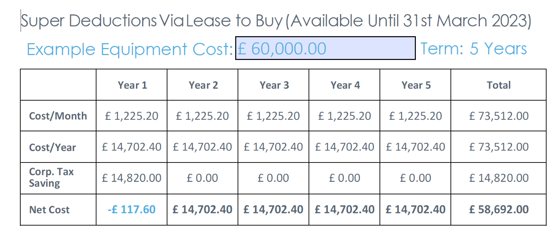

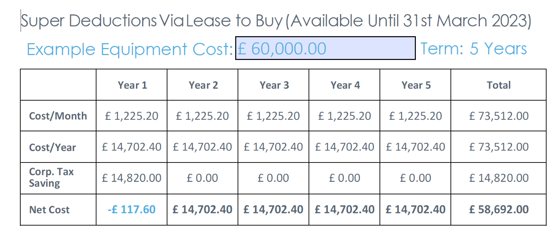

The Spring Budget announced a new 'Super Deduction' Tax Scheme.

The scheme will run from 1 April 2021 until 31 March 2023 and businesses investing in qualifying assets will benefit from up to 130% first-year capital allowance. So, if you're a Limited Company investing in new plant and machinery, you potentially save 25p for every one pound spent.

Payments illustrated are subject to status and VAT. Net Cost illustrated after tax relief.

What Assets will qualify for Super Deductions?

This applies to most new “plant and machinery”. Examples of which are:

- Commercial Vehicles: Vans, Lorries, Tractors

- IT: Software (including internally developed & bespoke) and Hardware

- Office Equipment: Tables, Chairs, Partitioning

- Refrigeration units

- Manufacturing equipment

This list is certainly not exhaustive. For more information on qualifying plant and material view the Super Deductions Fact Sheet.

What Assets do not qualify for the Scheme?

- Used or second-hand assets

- Assets included in General Exclusions (please follow this web-link for more details)

- Cars

- Long-life assets (with a useful economic life exceeding 25 years)

- Assets leased out to third parties

- Solar panels and electric car charging points, qualify for increased benefits under other changes announced in the budget. That is 50% first-year allowances for solar panels and 100% for charging points, these schemes run for different time periods.

What Funding Facilities can be used?

- Assets purchased for cash qualify for the Super Deduction as do assets acquired under Hire Purchase Agreements, Conditional Sale Agreements and Loans (particularly for IT Software purchases).

- Assets acquired under Rental Agreements, Finance Lease Agreements, Minimum Term Lease Agreements, and Operating Lease Agreements do not qualify for the Super Deduction.

As always we would suggest that you refer to your tax adviser/accountant for advice that is tailored to your business’s specific needs relating to the impact of The scheme on your company.